Bank Transfers

Discovery

During a fundraising year at Instant, leadership challenged each team to improve margins. After brainstorming across product, we identified the highest-impact idea: introducing expedited bank transfers with a small fee. Our existing ACH transfers were free but slow—often taking 2–3 business days, which left users waiting, especially over holidays. Offering a faster option improved the user experience while creating a new revenue stream.

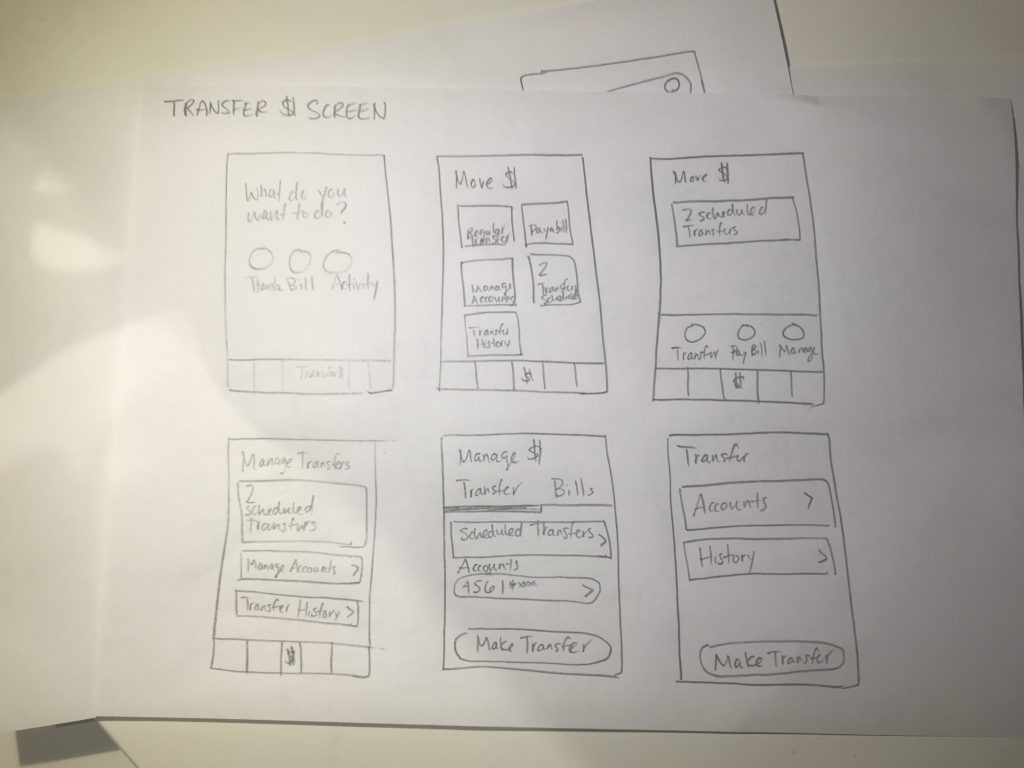

Current bank transfer screen

Problem research & validation

We gathered insights from both the business and users to understand pain points with the current bank transfer feature. Through in-house and remote interviews, we confirmed users were willing to pay for expedited transfers. We also uncovered that incorrect banking details were creating major issues for our customer support team. This project became an opportunity not just to solve key problems—but also to roll out our new rebrand in the app.

Ideation & future proofing

We ran a workshop with customer success, sales, development, and product teams to brainstorm ideas for bank transfers. After capturing all the ideas, we prioritized features needed for an MVP, keeping the other ideas in mind so we can future-proof the design.

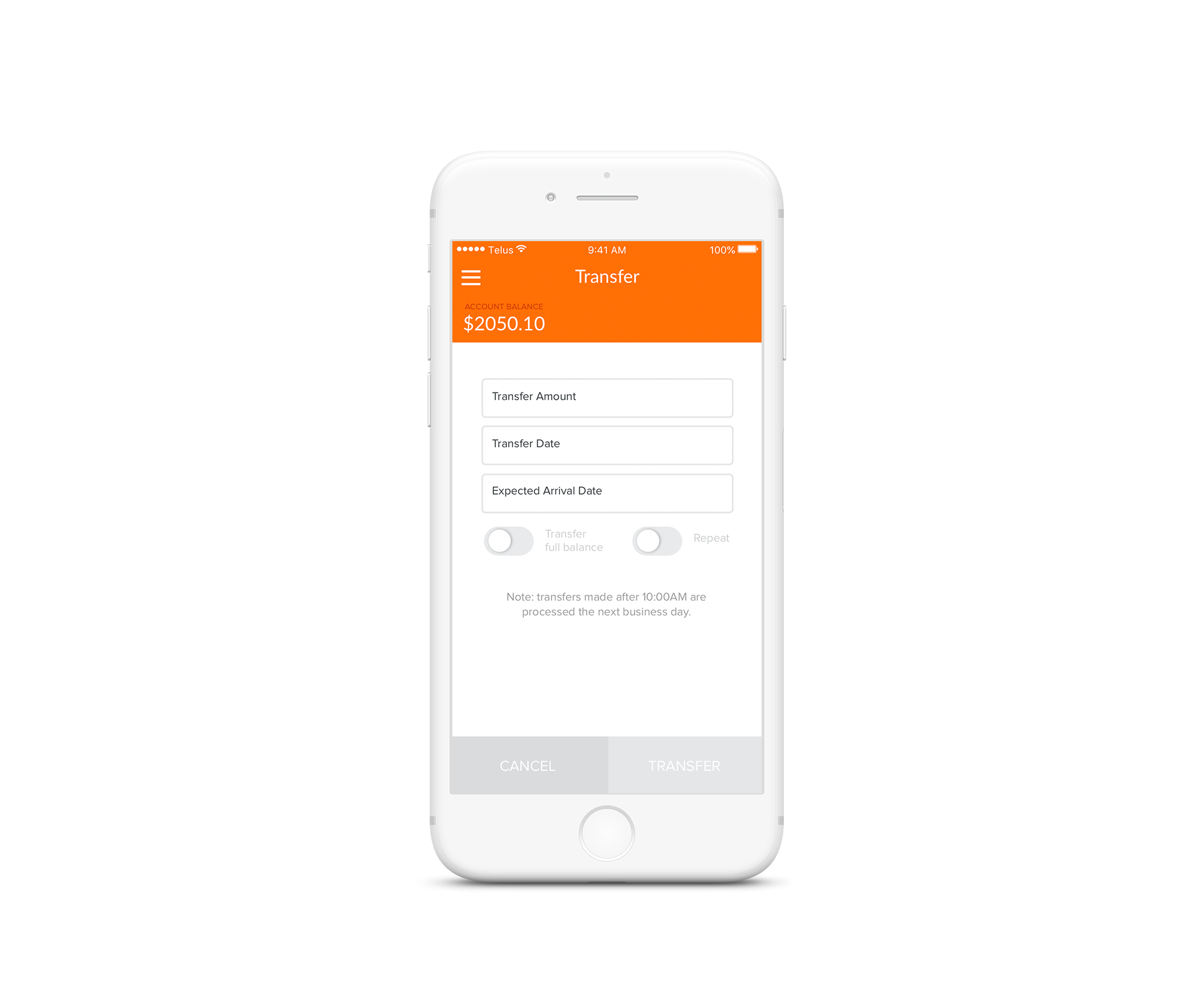

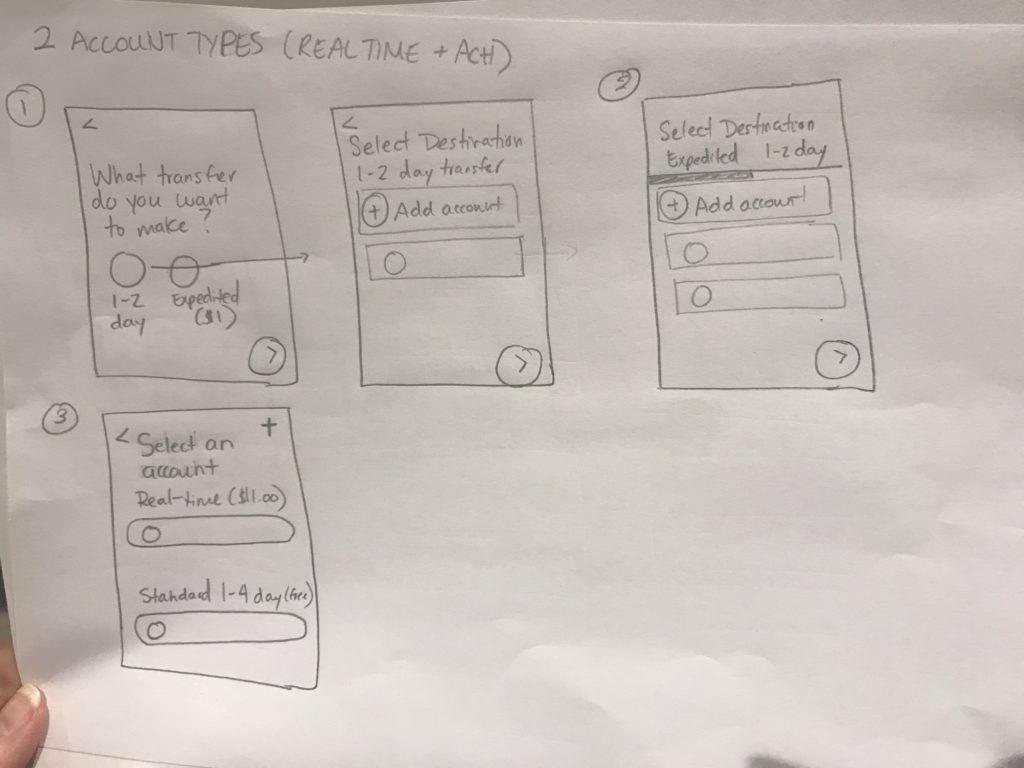

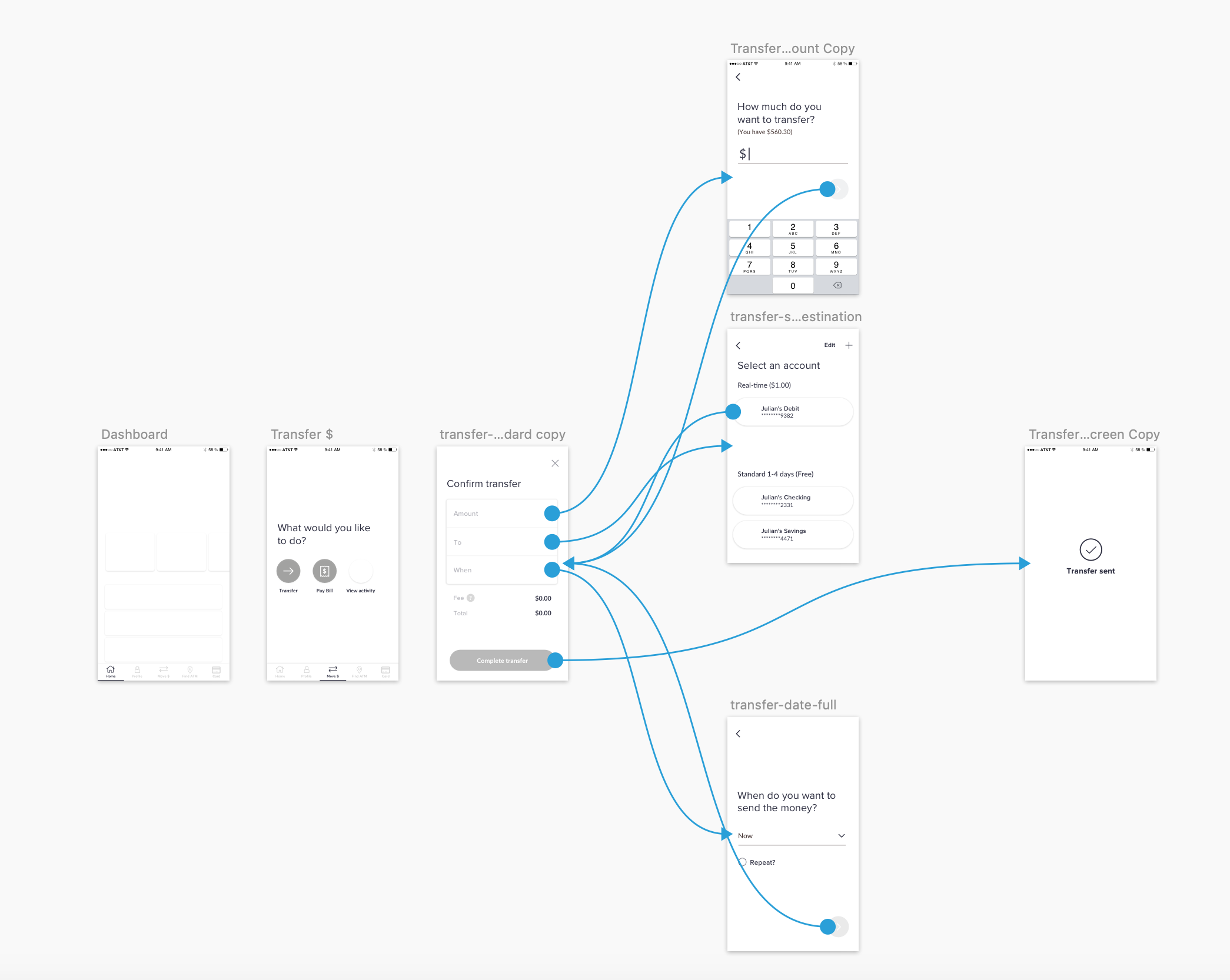

User journeys with surprise constraints

After a story mapping session with the product manager and developer, I began mapping out the potential user journeys. Initially, I envisioned a simple process: the user selects their account, enters the transfer amount, and chooses whether to expedite the transfer.

But, as is often the case, things weren’t that straightforward. The product manager shared that the banking details for expedited transfers differed from those for regular transfers. This meant we had to separate the two sets of information and figure out how to clearly communicate this difference to the user.

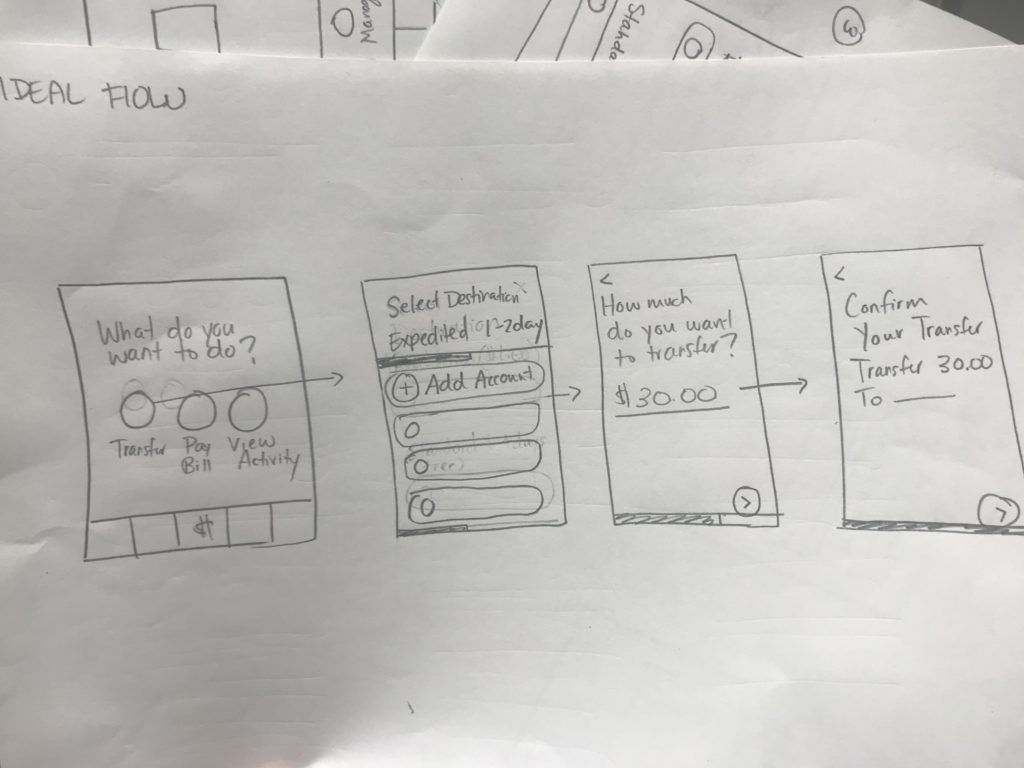

This was the ‘happy path’ flow…

Sketch time!

With the initial challenges behind us (though, spoiler alert… the flow did require some re-adjusting during wireframing), I moved on to sketching.

I began by designing the main screen, which needed to accommodate scheduled transfers, bill payments, transfer/bill history, account management, and actions like transferring money or paying bills. The goal was to keep the screen simple and focused on the three core actions: making a transfer, paying a bill, and viewing activity. Account management would be integrated into the flow of completing a transfer or bill payment.

Since activity was hidden behind a button, we still wanted users to easily see their scheduled transactions. To achieve this, we decided to feature a ‘Pending Transactions’ card on the app’s dashboard, which would also appear at the top of the ‘View Activity’ screen.

Then I sketched the flow of deciding between a regular ACH transfer versus an expedited transfer. This was where it got tricky since depending on the transfer the user selects, we needed different account info.

We narrowed it down to 3 options:

Option 1: Split the flow with buttons

Option 2: Use tabs

Option 3: Show all accounts and transfer types in one view (prioritise expedited at the top)

In the end we decided to test options 2 since option 1 would make it difficult for the user to navigate back and forth to see all the different accounts they had across the two transfer types and option 3 would be difficult to navigate if they had a list of multiple accounts.

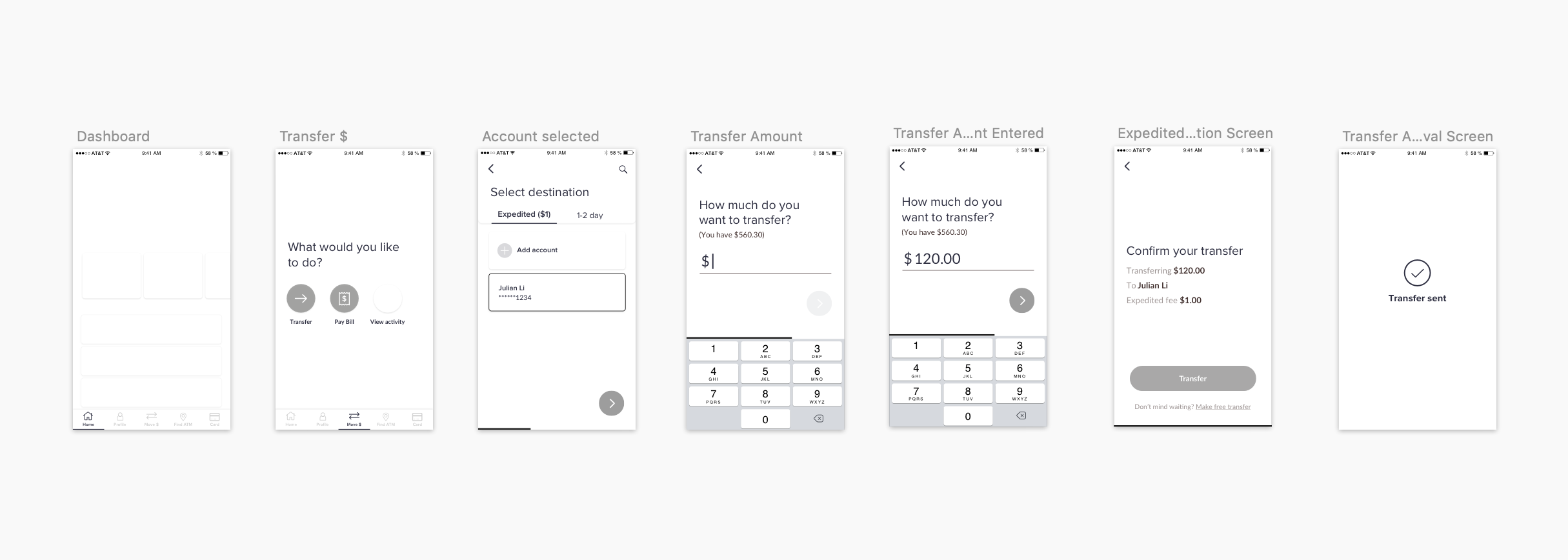

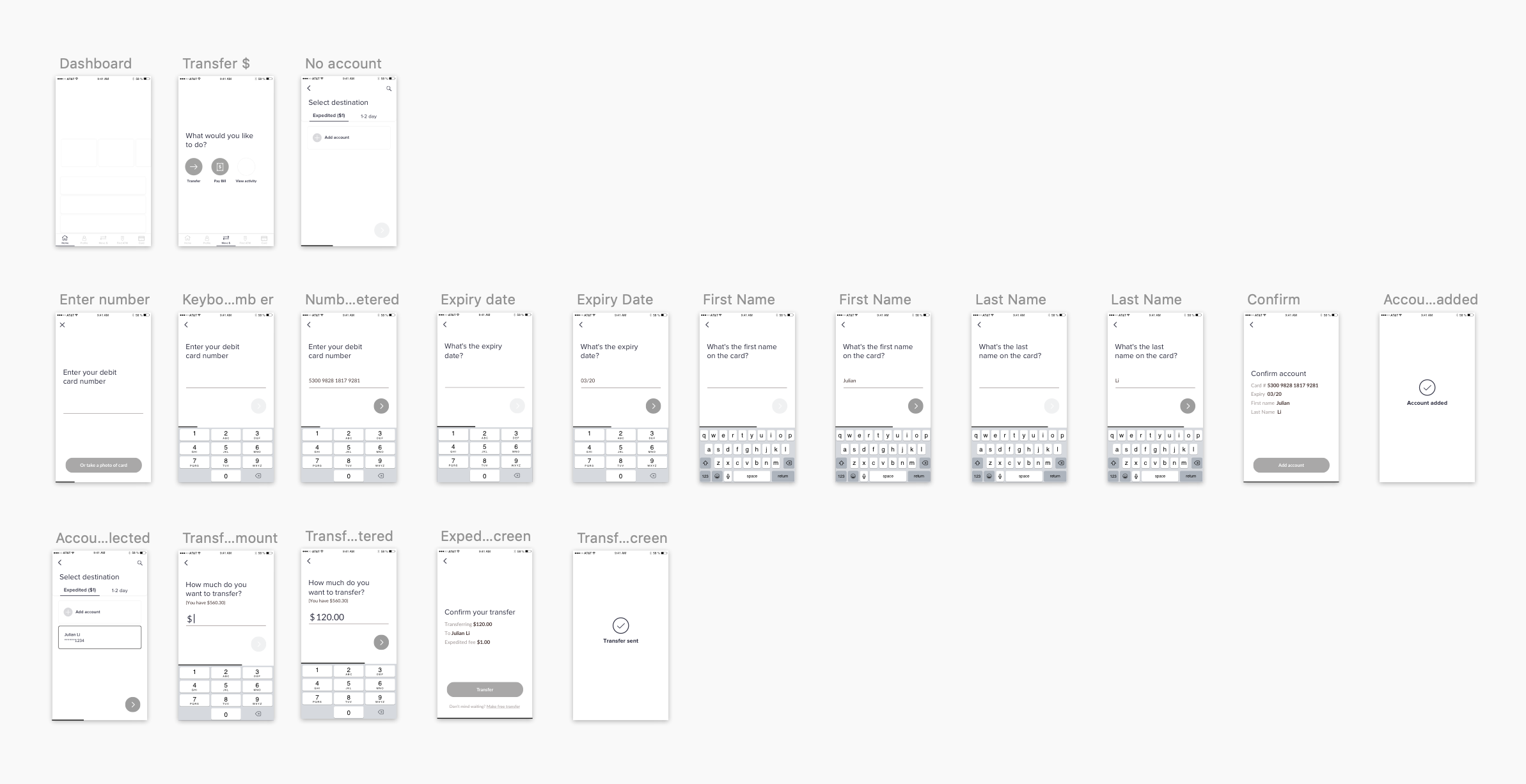

Wireframes & research

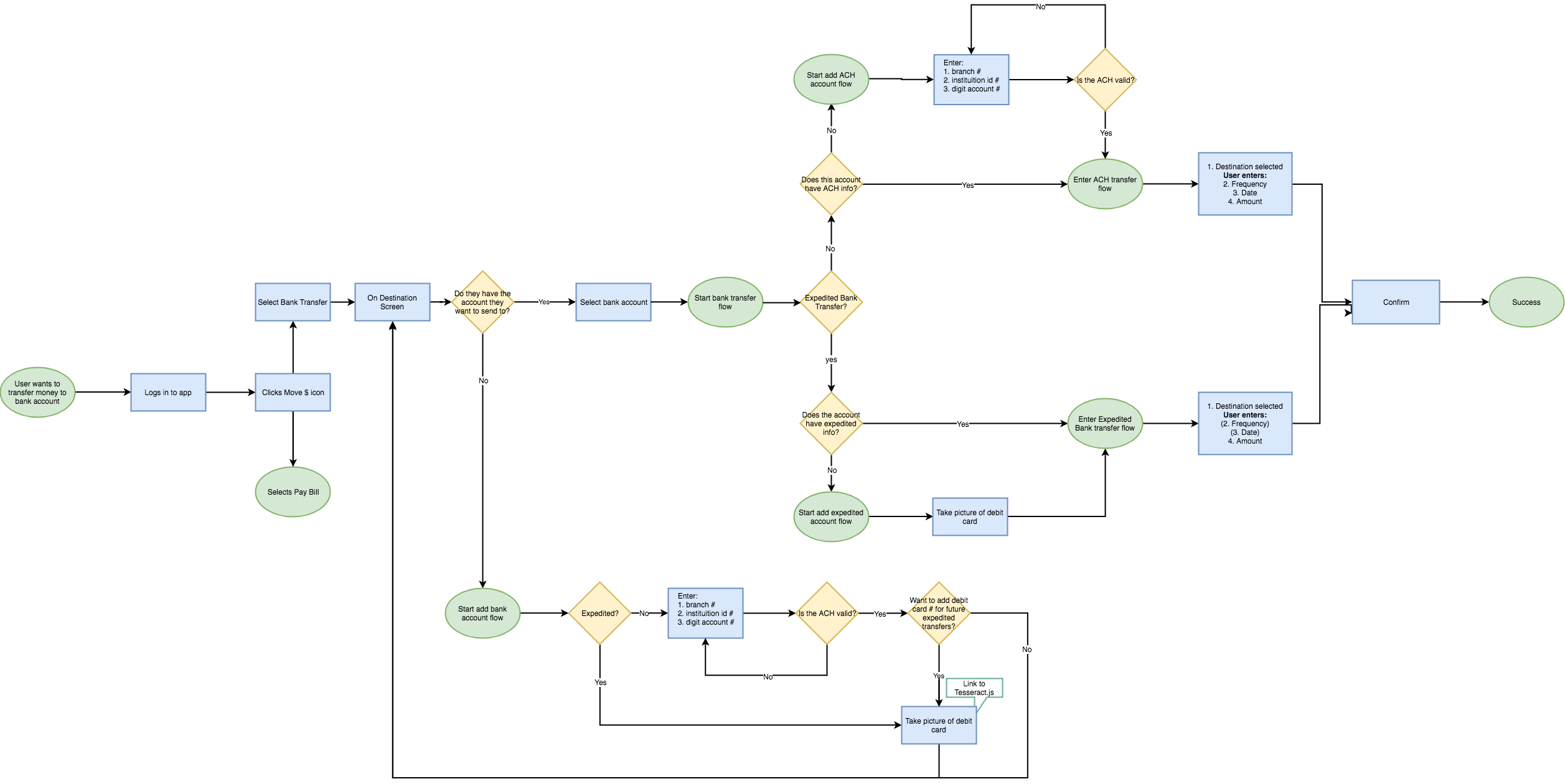

Here’s the bank transfer flow…

Here’s the flow for adding account details…

After wireframing and running a few usability tests, participants found it easy to complete a transfer, but we also discovered some issues:

- Some discovered the expedited fee at the end of the flow which meant if they wanted to remove it, they had go back multiple steps in the process.

- Participants reported that the process of adding account details and making a transfer felt long and it was difficult for them to know where they were in the process.

After reviewing the wireframes and research with the leadership team, they wanted us to prioritize expedited bank transfers over the regular ACH transfer in the flow in the hopes of it encourage users to use it more.

Changing the flow based on research & feedback

Based on these findings we knew what the design needed to do:

- Make it flexible enough so the user can navigate between transfer types at the end of the flow without needing to go through multiple steps again.

- Make it easier to navigate between the steps so they can edit the transfer easily.

- Speed up the process so making a bank transfer doesn’t seem so long.

We introduced a new screen into the process. The screen would layout the steps they needed to take and would allow them to navigate into the mini workflows of editing different parts of the transfer.

After testing the new workflow, we found that the summary screen helped solve the navigation issues and made it easier for the user to switch between different the two transfer types at the end of the flow, but it was still a slow and long process.

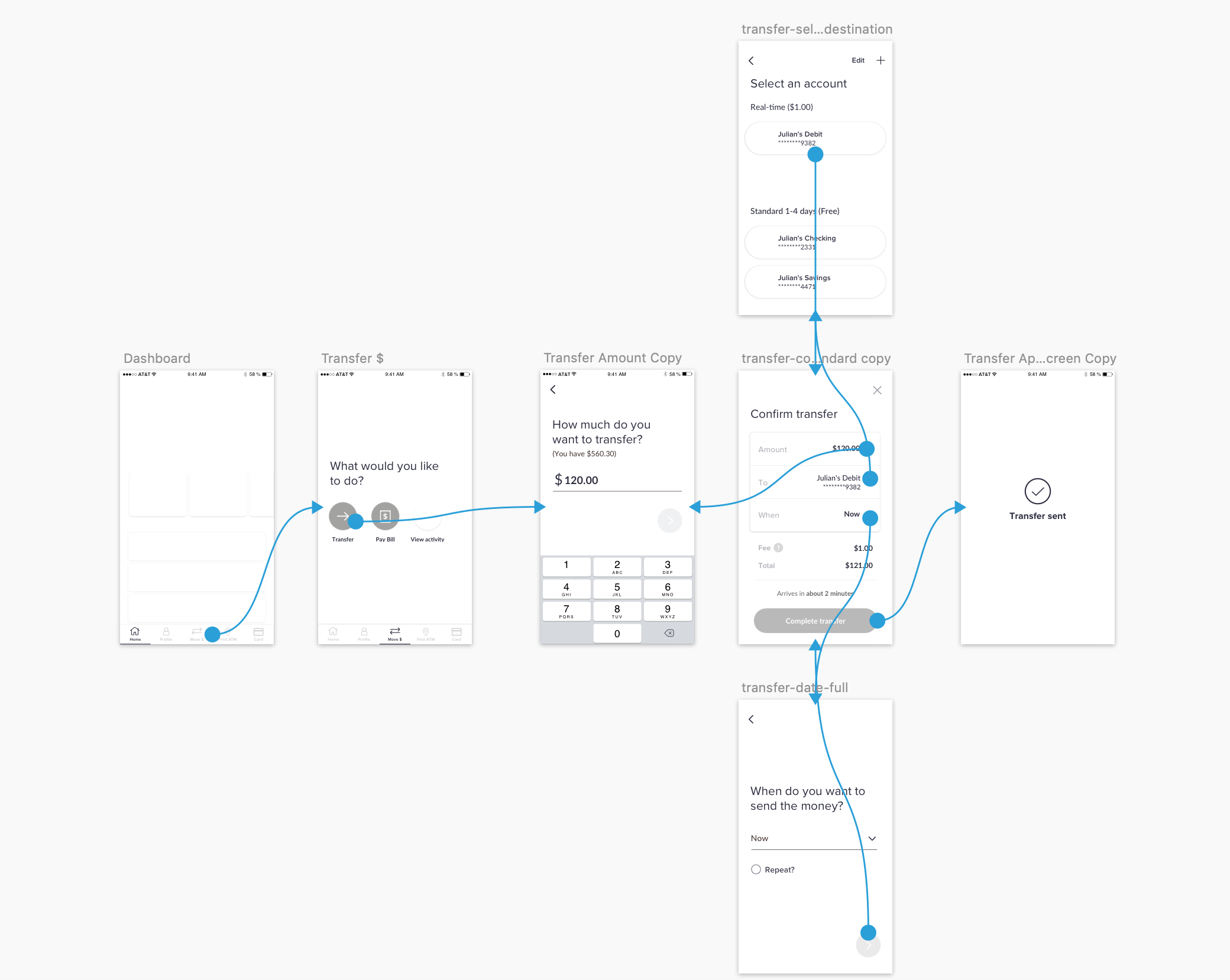

Speeding up the flow

To streamline the process, we explored the idea of auto-populating certain fields based on assumptions. For example, if a user already has an account linked, we can predict where they want to send the transfer. If they have both expedited and regular transfer accounts, we could subtly encourage them to choose the expedited option.

Instead of asking the user to select the transfer timing, we made the assumption they’d want the transfer completed immediately by default, with the option to schedule or set up recurring payments if needed.

Finally, we moved the “How much money do you want to send?” question to the beginning of the flow, as the only piece of information still required at this point was the transfer amount.

More research & interesting lessons

After testing the new flow, we discovered that users found it quick—but perhaps too quick. They care deeply about their money and wanted to feel assured that their transfer was being handled with care. The ability to complete a bank transfer in mere seconds didn’t instill confidence. To address this, we introduced a confirmation screen at the end of the flow, giving users the option to actively dismiss it. This added step reassured them that we were taking the necessary precautions with their money.

While participants easily made expedited transfers, they struggled slightly when attempting to switch to a regular ACH transfer. After discussing with the leadership team, we decided to accept this minor friction, as it encouraged users to opt for expedited transfers. I felt, however, that users who didn’t need the expedited service were inconvenienced, but ultimately, this was a trade-off the team was willing to make. If I could revisit this project, this would be the one aspect I’d adjust.

Final designs

Results post launch

In the first 3 weeks of feature launching, it generated $40,000 USD for the company.

Over the last 8 months, over $13,033,210 in funds has been transferred using this feature and in the end it improved the companies margin from 36% to 50%.

Category:

Instant Financial